Economic well-being at older ages: prospects for the future

PDF document available at: https://www.un.org/development/desa/dpad/wp-content/uploads/sites/45/publication/PB150.pdf

Worldwide, populations are ageing rapidly due to gains in life expectancy and declines in fertility. The trend towards a growing number and share of older persons is projected to continue in the foreseeable future. As the number of older persons grows, their socioeconomic and demographic characteristics will evolve as well, with implications for economies, societies and public budgets.

While long-term trends are hard to predict, assessing the characteristics of current and future cohorts of older persons provides important insights into the future of our ageing world. On the one hand, future cohorts of older persons are likely to be healthier and more educated—and therefore more productive—than those of today, despite the impact of the Covid-19 pandemic. Continuing scientific and technological innovations, including medical and pharmaceutical advances, will allow many to enjoy healthier and longer lives. On the other hand, the information presented in this brief indicates that successive cohorts of youth and adults are increasingly insecure in the labour market and more and more unequal in both developed and developing countries with available data. Without swift and bold policy action to counter this trend, future cohorts of older persons may be more unequal than those of today.

PRECARIOUS WORK AND LACK OF EMPLOYMENT DRIVE ECONOMIC INSECURITY

Over the last decades, there have been important changes in the world of work. Labour market participation has helped millions of people to escape poverty and has economically empowered women and other disadvantaged groups.

However, deficits in decent work are large and persistent. Full-time jobs under standard employment contracts have ceased to be the norm, even in developed countries. Involuntary temporary, part-time and casual work, including zero-hours contracts, sub-contracted labour and self-employment, are on the rise. Workers under new forms of employment – such as own-account workers in a growing “gig” economy – have little employment security, unsteady incomes and limited access to social protection, much like workers in the informal economy.

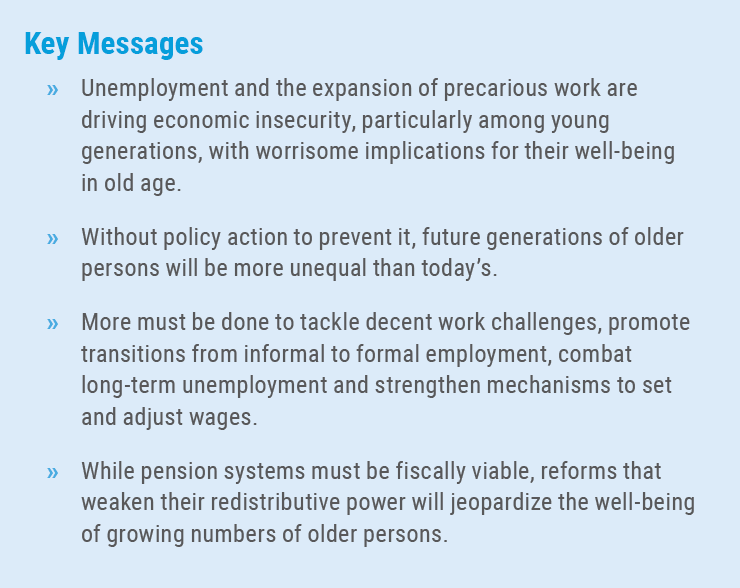

At the same time, unemployment has been growing across successive cohorts of workers. In both developed and developing countries with data, unemployment rates have increased at practically all ages, from one ten-year birth cohort to the next, for those born between the 1920s and the 1980s (figure 1). For workers aged 25 to 29, for instance, unemployment rose from 9 per cent for the cohort of people born in the 1940s, on average, to 12 per cent for those born in the 1980s in developed countries. For workers aged 55 to 59, it climbed from 6.5 per cent for those born in the 1920s to 9 per cent for the 1960s cohort. In developing countries, the shorter cohort series also suggests rising unemployment from one cohort to the next, particularly among younger workers.

For young men and women, labour market participation has also been declining. This decline is partly due to the fact that young people spend more years in education; but the number of youth who are not in employment, or education or training has also been growing. This represents a severe waste of human potential and can have drastic repercussions, both for the young people directly affected and for societies at large.

Unemployment is an important indicator of labour market trends, but it gives an incomplete measure of deficits in decent work. In low- and middle-income countries, many workers who lack opportunities in the formal economy turn to informal employment, where earnings are lower and less reliable, on average, and working conditions are more precarious. In 2019, an estimated 60 per cent of workers worldwide—over 70 per cent in developing countries— worked in informal employment (ILO, 2021). Informality is stubbornly high in most developing countries with data and has even grown in some.

Persistent informality and the rise of non-standard forms of formal employment pose a challenge for income security in old age. Most workers in informal employment do not pay into contributory pensions or other social protection programmes. The ability of these workers to save privately and regularly is also limited by liquidity constraints: they face barriers to accessing formal and reliable financial services and their wages are lower and more unreliable, in general, than those of workers in formal employment (ILO, 2021). Many workers in the “gig” economy, own-account workers and those with temporary or part-time contracts face many of the same barriers due to their unsteady incomes and lack of employment security.

INCOME INEQUALITY IS RISING

While unemployment and the increase in precarious forms of work affect low- and middle-income workers more than high-income earners, top wages and top incomes have grown very fast in recent decades. At the same time, top income tax rates have declined, as have tax rates on dividend income and corporate income (OECD, 2019).

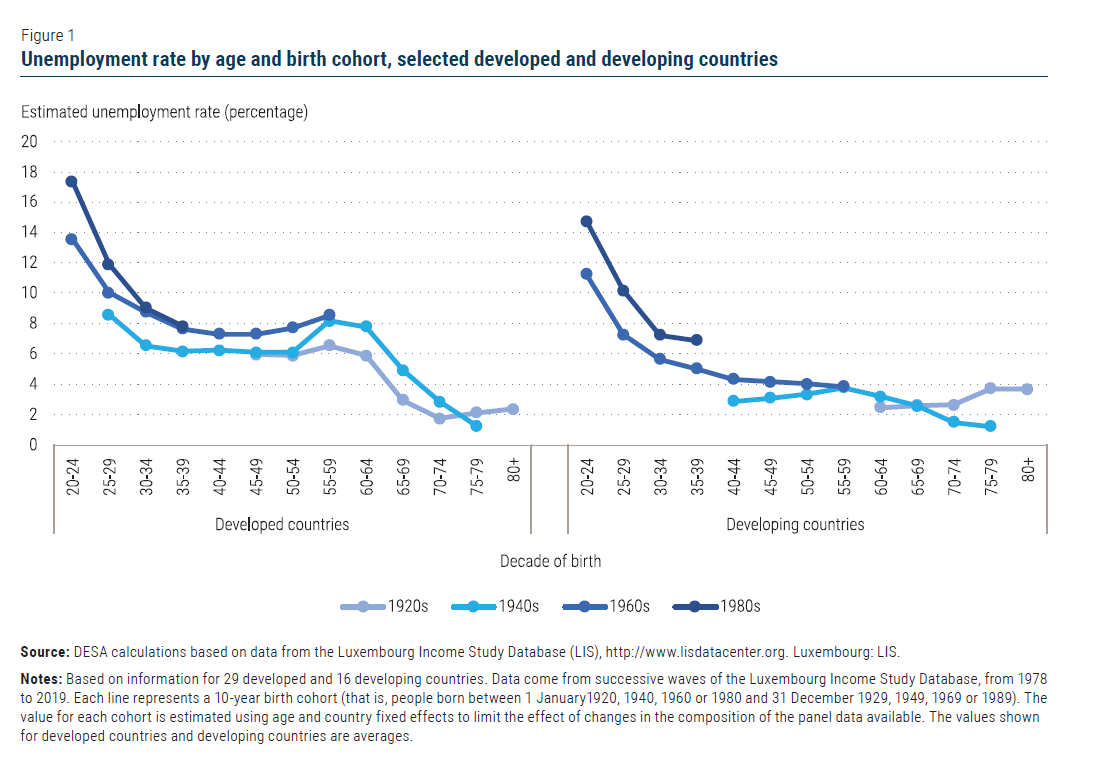

As a result, income inequality, as measured by the Gini coefficient, has increased among people of working age from one birth cohort to the next (figures 2a and 2b). In developing countries, the Gini has increased steadily from one ten-year birth cohort to the next at all ages. Cohorts born in the 1960s or later, who will turn 65 between now and the 2050s, are particularly unequal: Gini coefficients for these cohorts—between 44 and 45—are well above the world’s average—which stood at 38 around 2015 (United Nations, 2020). In developed countries, inequality is also deepening across cohorts, but with exceptions. Thus, there is a high chance that younger cohorts will face higher income inequality once they reach age 65 than the older persons of today. The failure to translate general progress into widespread wellbeing, including among older persons, poses significant challenges to the pledge of leaving no one behind.

DECENT WORK AND ADEQUATE PUBLIC PENSIONS ARE KEY TO REDUCE INEQUALITY AMONG FUTURE GENERATIONS OF OLDER PERSONS

Assessments of the implications of population ageing should not be based on the assumption that future generations of older persons will be similar to today’s. Accounting for improvements in health and education across cohorts, for instance, would lead to a more optimistic outlook of future gains in productivity and of future economic contributions of older persons than scenarios that consider only changes in age structures.

Despite these improvements—and absent major policy correctives—future generations of older persons will likely be more unequal and economically insecure than today’s. Some will have enjoyed stable working lives and steady wages but an increasing number will have had to cope with unstable career paths and low earnings. Pension systems and other social protection programmes could compensate older persons for the inequality generated by the labour market experience of retiring generations, but this may be difficult to achieve at a time when many countries are considering ways to reform pension systems.

Indeed, the increase in the share of older persons and in the number of years spent in retirement have raised concerns over the sustainabilility of pension budgets in many countries. Measures aimed at ensuring fiscal sustainability must factor in the need for public pensions to provide income security to all older persons, particularly against the prospect of higher inequality and employment insecurity among future generations. In countries with comprehensive social protection systems, the challenge is to maintain the real value of pensions and their poverty- and inequalityreducing effects. In countries without such systems, the focus should be on extending pension coverage in accordance with target 1.3 of the Sustainable Development Goals. For the youngest generations examined in this brief, who are currently in their 30s and 40s, as well as those who will come after them, the most far-reaching set of strategies to extend pension coverage and promote economic security in old age are those geared towards the creation of decent jobs.

More must be done to tackle the decent work challenge, promote transitions from informal to formal employment, combat long-term unemployment, strengthen mechanisms to set and adjust wages, and support unionization and other forms of collective representation. There is also scope for promoting decent work opportunities for older persons, should they wish to remain in the labour market, and for eliminating barriers to their participation.

Addressing informality and creating decent jobs are gradual, long-term processes. In the short term, the key challenge in extending pension coverage is to reach workers in informal employment as well as many of those under new forms of employment. There is no one-size-fits-all path to increasing pension coverage but two actions can help. The first one is to introduce or expand first tier, tax-funded pension schemes so that all older persons maintain a basic level of income security. These schemes should be made available to all, including workers in informal employment and other groups that are often not covered by contributory pensions. The second type of action is to encourage retirement savings within well-regulated private financial and pension systems, and to improve financial literacy.

In both developed and developing countries, there is scope for raising public revenues without increasing the tax burden on low-income workers or the middle class—namely by raising top income tax rates and considering taxes on wealth. In developing countries, reducing levels of informality will go a long way in expanding the tax base, as will tackling capital flight, illicit financial flows and undertaking the necessary reforms to strengthen tax administration, as advocated in the Addis Ababa Action Agenda. While it will take time for these reforms to bear fruit, it is imperative for countries to undertake them, both to address the effects of the acute crises the world is suffering from now, and to promote economic security and equity among current and future generations, including in old age.

Ultimately, ensuring the well-being of future older persons entails reforms to both the spending and revenue sides of public budgets. While pension systems must be fiscally viable, reforms that weaken their redistributive power will jeopardize the well-being of growing numbers of older persons.

Authors: Marta Roig and Daisuke Maruichi, Global Dialogue for Social Development Branch, Division for Inclusive Social Development, UN DESA.

Note: This Policy Brief draws on work undertaken and reported in the World Social Report 2023.

Welcome to the United Nations

Welcome to the United Nations